The 2026 investment landscape is characterized by moderate U.S. economic expansion supported by accommodative monetary policy while stable labor markets and ongoing AI infrastructure spending provide a solid foundation for growth. Equity markets face competing forces of strong corporate earnings and broadening AI adoption against elevated valuations and significant concentration risk in mega-cap technology stocks, while international markets offer attractive opportunities supported by a weaker dollar and more moderate valuations. Fixed income investors must navigate a structurally shifting landscape where high-quality corporate bonds increasingly compete with sovereign debt for safety, necessitating active duration management and flexible sector allocation as the Treasury yield curve steepens amid persistent fiscal deficits.

2025 Market Recap

- The S&P 500 Index posted an impressive 18.20% year-to-date return as of December 5, 2025

- The market experienced a severe 18.75% correction between February 19 and April 8, followed by a powerful 39.04% recovery rally, pushing indices into record highs.

- The “Magnificent 7” technology giants – Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla – played a pivotal role in this turnaround, posting a remarkable 25.76% year-to-date return as of December 5th.

- International developed markets gained 29.74% year-to-date while emerging markets advanced 32.23%, demonstrating that the global rally was even more powerful outside U.S. borders, representing a dramatic shift from previous years when U.S. exceptionalism drove consistent domestic outperformance.

The Tale of Two Markets: Correction and Recovery

The February-April Correction: Policy Shock and Economic Uncertainty

The year 2025 began with optimism but quickly turned turbulent when President Trump’s “Liberation Day” tariff announcements on April 2 triggered the S&P 500’s worst two-day performance since March 2020, and a 24.15% decline in the Nasdaq from its December high.

The comprehensive trade policy overhaul, featuring reciprocal tariffs and baseline levies of 10% across all trading partners, sent shockwaves through global markets.

The severity of the correction was amplified by multiple concurrent factors: heightened inflation expectations (with University of Michigan’s 5-year expectations jumping to 3.5%, the highest since 1995), deteriorating consumer confidence (falling to levels not seen since Spring 2020), and the first quarterly Gross Domestic Product (GDP) contraction in three years (-0.3% in Q1). The VIX Volatility Index surged to levels indicating acute market stress, while investor uncertainty metrics reached their highest levels since November 2020.

The April-December Recovery: Resilience and Rotation

The remarkable recovery that began on April 8, 2025, was triggered by President Trump’s announcement of a 90-day pause on higher-level reciprocal tariffs to allow for negotiations, though China remained excluded with tariffs increased to 145%. From the April 8 bottom through December 5, the S&P 500 surged 39.04%, the Nasdaq rocketed 55.11%, and the Russell 2000 climbed 44.45%. The Magnificent 7 Index delivered an exceptional 69.46% recovery, completely erasing the steep February-April declines and pushing indices substantially beyond previous highs. Tactical policy relief, combined with rebounding consumer confidence (Conference Board Index jumping 12.3 points to 98 in May) and surprisingly strong corporate earnings, catalyzed one of the most powerful market rallies in recent history.

Artificial Intelligence: The Dominant Market Theme

Artificial Intelligence (AI) emerged as the single most powerful market driver in 2025, with AI-related enthusiasm fueling extraordinary returns across multiple sectors. The AI investment boom intensified throughout the year as the Magnificent 7 companies alone deployed approximately $350 billion in capital expenditures for AI infrastructure. AI chip leader, Nvidia, reported visibility into over $500 billion in orders for current and next-generation chips over five quarters, while Microsoft and Alphabet acknowledging they fell behind in building AI capacity. The benefits of the AI revolution gradually spread beyond mega-cap technology names. Industrial and Consumer Discretionary sectors also showed strong AI-related performance, suggesting the market rally was broadening beyond its initial narrow leadership.

However, the AI boom also contributed to valuation risk, with the cyclically adjusted price-earnings ratio exceeding 40 – territory last visited during the dot-com bubble’s peak in 2000 even though Information Technology delivered 22.6% year-over-year earnings growth in Q2 2025, and the Magnificent 7 posted 26.6% earnings growth with 100% of these companies beating earnings estimates.

Federal Reserve Policy: Navigating Unprecedented Complexity

The Federal Reserve (Fed) faced an acute dilemma in 2025: persistent inflation colliding with labor market deterioration. After maintaining the benchmark Fed Funds rate at 4.25%-4.50% throughout much of the year, the Fed cut rates through the fall, including a quarter-point reduction at its December 10, 2025 meeting, bringing the target range to 3.5%-3.75%. However, the December meeting marked a pivotal shift in tone, with the Fed signaling a transition from consistent easing to a more cautious, “wait-and-see” approach for 2026.

Corporate Earnings: Strength Amid Uncertainty

Corporate America delivered exceptional performance throughout 2025, surpassing elevated expectations across multiple quarters. Q1 2025 demonstrated robust corporate resilience with 78% of S&P 500 companies beating earnings estimates. Q2 delivered even stronger results, with 81% posting positive earnings surprises, while Q3 saw 83% surpass estimates. Earnings growth was the strongest in these two quarters than any quarter since Q2 2021.

However, this strong fundamental performance came alongside elevated valuations that warranted caution. The forward 12-month price-to-earnings (P/E) ratio expanded to 22.4 by mid-year, significantly above both the 5-year average of 19.9 and 10-year average of 18.4. Since Q2’s end, much of the market’s advance was driven by multiple expansion rather than earnings growth, indicating that valuation expansion rather than fundamental improvement drove recent gains.

Sector Performance: Technology Dominance and Defensive Pressures

Technology commanded market leadership throughout 2025, posting a remarkable 26.68% year-to-date return, driven by AI infrastructure investments, strong earnings execution, and renewed investor confidence following the tariff policy relief. Communication Services also showed strength with 22.06% gains, benefiting from technology exposure and improved advertising trends.

Industrials emerged as a surprise outperformer with 18.51% returns, reflecting renewed confidence in economic growth and AI datacenter spending. Utilities provided steady returns of 16.79% as investors focused on the inadequate power grid and climbing demand for power. Healthcare posted solid 12.88% gains despite regulatory uncertainties, while Financials delivered 12.21% returns supported by steeper yield curves and economic resilience.

In contrast, defensive sectors struggled to keep pace with the broader rally. Consumer Staples gained just 1.72% year-to-date and declined during multiple periods throughout the year, while Real Estate posted modest 3.11% returns despite lower interest rates. Materials showed a 6.33% performance despite significant earnings estimate reductions throughout the year. Energy advanced 9.87% but faced headwinds from volatile oil prices and the transition toward renewable energy.

International Outperformance: A Historic Reversal

One of 2025’s most significant developments was the dramatic outperformance of international markets versus U.S. equities – a reversal of the pattern that had dominated for over a decade. Driven by Germany’s €500 billion infrastructure fund and European Central Bank rate cuts. The MSCI World ex-USA delivered exceptional 29.74% year-to-date returns through December 5, substantially outpacing the S&P 500’s 18.20% gain. Emerging markets performed even better with 32.23% returns, driven by dollar weakness and improving economic conditions in developing nations.

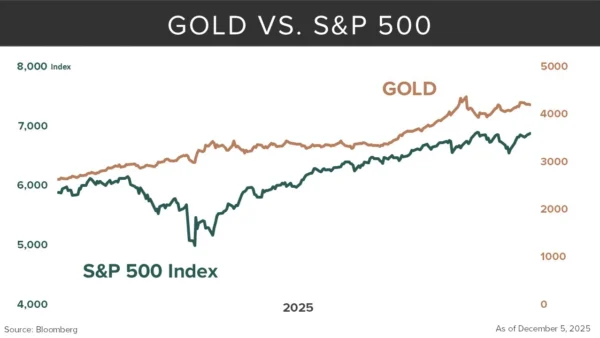

Alternative Assets: Gold Shines, Crypto Struggles

Gold emerged as the standout performer among alternative assets, delivering an exceptional 59.95% year-to-date return through December 5, 2025. The precious metal’s surge of 40.71% from April lows established it as the year’s ultimate “policy hedge” asset, benefiting from dollar weakness, inflation concerns, geopolitical uncertainties, and record central bank accumulation. Gold’s remarkable performance revalidated its role as a safe haven asset during periods of economic and political uncertainty.

In stark contrast, cryptocurrencies struggled significantly in 2025. The Bloomberg Galaxy Crypto Index declined 15.61% year-to-date despite a powerful 44.25% recovery from April lows. The asset class faced a brutal 34.77% decline during the February-April correction and continues to experience extreme volatility.

Economy

The U.S. economy enters 2026 navigating a complex landscape shaped by diverging sector performance and evolving policy dynamics. While certain areas demonstrate resilience and growth momentum, others reveal emerging vulnerabilities that warrant careful monitoring.

Labor Market

The U.S. labor market remains stable despite signs of softening. Nonfarm payroll gains have slowed in recent months, yet leading indicators such as the 4-Week Moving Average of Initial Claims Index still points to a relatively healthy environment. The current unemployment rate of 4.6%, though slightly elevated from recent lows, remains historically low. Job openings exceed 7.6 million, demonstrating continued demand for workers. Health care and leisure/hospitality industries show particularly solid

job growth.

However, several near-term risks warrant attention. Layoffs have risen across multiple segments, and historically, when layoffs broaden, economic activity tends to slow in subsequent quarters. Another concern involves an oversupply of college-educated workers. Among recent graduates aged 20 to 24, unemployment stands near 9.7%, a rate typically associated with weaker growth. Developments in AI may increase labor market headwinds and reshape demand patterns, making this trend particularly important to monitor.

Despite these pressures, broad labor demand in key sectors continues to support modest expansion. Analysis of employment indicators reveals a favorable backdrop despite headwinds related to the pace of growth and layoff trends. Current readings do not suggest any significant slowdown or imminent recession as 2026 begins.

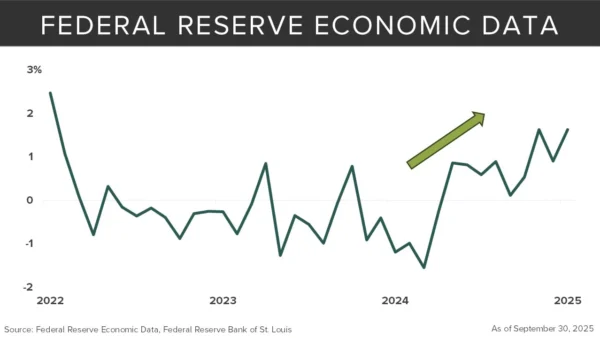

Manufacturing

U.S. manufacturing, measured by industrial production, has posted growth on a month-over-month basis. Industrial production – a gauge of economic growth with strong correlation to GDP, rose 1.6% year-over-year in September, with monthly output up 0.1%. The closely followed ISM Manufacturing PMI Index shows mild contraction in demand as tariffs raise input costs and compress margins. However, the production component has turned positive recently, suggesting companies have resolved some tariff-related supply chain and production challenges.

Investment in machinery, computers, and electronic products continues to support the sector. Infrastructure projects and data center construction drive demand, supported by more than $500 billion in semiconductor and AI-related investments.

The sector appears positioned to stabilize. Our manufacturing indicators present a robust picture, with readings coming off recent highs. This strength persists despite moderating global growth and tariff pressures. Current investment in AI infrastructure and fiscal support should sustain manufacturing activity into at least the first half of 2026. These indicators remain consistent with moderate expansion and positive growth expectations for 2026.

Consumer

U.S. retail sales and consumer spending have demonstrated resilience over the past year. The latest data for Adjusted Retail & Food Services Sales Index shows a rise of 4.3% in September, slightly above the 4.2% year-over-year average for the last 20 years. Early holiday data reveals strong growth for “Cyber Week,” which includes Thanksgiving through Cyber Monday. Spending increased 7.7% compared to last year, approaching but not surpassing 2024 levels. Traffic during the period set records as shoppers focused on value and promotions.

However, many regional Federal Reserve offices indicate mounting strain on consumers. Consumer spending has weakened notably among low and middle-income households as elevated tariffs drove up retail costs. As Fed officials debate interest rate cuts, rising prices continue to weigh on consumer minds. The economy exhibits a pronounced K-shaped recovery. The wealthiest 10% of consumers now drive nearly half of all spending, supported by surging asset values. Meanwhile, the bottom 80% of earners struggle with stagnant purchasing power as their spending barely outpaces inflation. This deviation masks the financial distress affecting the majority of American households.

Sentiment among consumers has yet to rebound. The Consumer Confidence Index (Conference Board) for the U.S. fell sharply in November, dropping to 88.7 from 95.5 in October. Both the Present Situation Index and Expectations Index declined, with expectations remaining below 80 for ten consecutive months. Persistent inflation concerns, combined with lingering effects from the October-November 2025 government shutdown and the prospect of another shutdown in early 2026, continue to weigh on consumer sentiment. Consumers report less optimism about jobs and income, and their inflation expectations rose to 4.8%. Spending plans for big-ticket items and vacations weakened, though healthcare spending increased. Consumers are shifting toward essential services and expressing increased caution.

Our indicators suggest weakness across the consumer sector as income, savings, and sentiment have deteriorated over recent readings. This segment aligns more closely with the late phase of the business cycle and suggests slower growth as 2026 begins.

Housing

The housing market occupies a weak but stable position. Elevated mortgage rates and home prices have kept many potential buyers and sellers on the sidelines, limiting transactions and keeping existing home sales near their lowest levels in decades. Tight inventory and solid household finances have allowed national home prices to rise, with the S&P Case-Shiller U.S. National Home Price Index increasing 1.3% year-over-year.

The outlook for 2026 includes several headwinds as sluggish activity for both investors and buyers weighs on the market. Housing affordability in the U.S. remains a significant challenge due to high prices and relatively high mortgage rates. Median home prices have risen 31% since 2019, increasing mortgage payments and limiting the ability to purchase homes. Additional barriers such as high material costs, restrictive zoning, labor shortages, and lengthy permitting processes continue to constrain housing supply.

Housing appears as the weakest link in the array of macroeconomic indicators. The segment continues to trend lower and indicates weakening growth that may turn negative. Elevated prices and high borrowing costs will likely restrain both demand and construction.

However, if additional rate cuts materialize over the coming quarters the housing market could rebound.

Equity

As we approach 2026, investors face a complex landscape defined by competing forces. The U.S. economy is advancing into its late economic and credit cycles, yet accommodative policy continues to delay a potential slowdown. Market concentration in AI-related mega-cap stocks presents both opportunity and risk, while valuations remain elevated across major indices.

The global policy backdrop remains supportive, with central banks maintaining an easing bias that should keep financial conditions loose. This environment encourages risk-taking and corporate investment, even as geopolitical tensions, tariff uncertainties, and the value of the U.S. dollar test investor conviction. The performance of international stocks relative to U.S. equities will depend heavily on these currency dynamics and trade policy developments. These crosscurrents shape our macro view for the year ahead.

Global Macroeconomic Environment

Central Bank Policy: An Easing Tide

Federal Reserve and global central bank policies are easing and becoming more accommodative, providing crucial support for risk assets. Most central banks around the world are either cutting rates or holding steady.

Liquidity conditions remain supportive for risk assets. China’s elevated money growth has yet to decline, adding to global liquidity pools and supporting asset prices across regions. Near-term recession risk remains low, providing a stable foundation for corporate earnings and investment. Private credit conditions are benign, with non-private credit posing minimal systemic concerns. The global economy stands on the threshold of a cyclical upswing, supported by these favorable monetary conditions.

Global Economic Signals

While global economic growth is slowing, several positive developments have emerged that provide reasons for cautious optimism. Lower oil prices are easing input costs for businesses and consumers alike, supporting margins and disposable income. The weaker U.S. dollar is providing relief to emerging markets who have often issued dollar-denominated debt, and boosting the competitiveness of international exporters, while also supporting the translation of foreign earnings for U.S. multinationals.

Inflation, while higher than the Fed’s target, has been stable thus far, reducing the pressure on central banks to tighten policy prematurely or reverse course on easing. Perhaps most importantly, the global trade war has moderated for the most part, removing a significant source of uncertainty that had weighed on business confidence and investment decisions. However, the impact of tariffs remains a key variable to monitor, as policy shifts could quickly alter the trade landscape.

U.S. Market Assessment

The U.S. market presents a picture of cautious optimism. Fundamentally, the economy remains strong, but the stock market valuation and concentration in the AI space are both sounding alarm bells for some analysts. The U.S. is getting later in its economic and credit cycles, yet policy remains supportive enough to delay a slowdown.

Investment Tailwinds

Strong corporate earnings and AI spending provide a solid floor for equity prices. The Technology sector continues to deliver impressive profit growth, with AI-related capital expenditure driving revenue expansion across the semiconductor, cloud computing, and software industries. The potential upcoming fiscal stimulus could boost cyclical value sectors like Financials and Industrials, potentially broadening market participation beyond the narrow set of mega-cap leaders that have dominated returns.

The supportive monetary policy environment, combined with resilient consumer spending and corporate investment, creates conditions favorable for continued earnings growth. Small-cap stocks may benefit disproportionately from this environment, given their greater sensitivity to domestic economic conditions and financing costs.

Investment Headwinds

High valuations and persistent policy uncertainty, particularly tariff risk, warrant caution. The concentration of returns in a narrow set of AI leaders continues to drive market performance but also amplifies idiosyncratic risk. Global investors have digested a rapid pace of policy change, but this sentiment and hedging behavior with it can turn on a dime. The late-cycle positioning of the U.S. economy suggests that while a recession is not imminent, the margin for error has narrowed.

| Tailwinds | Headwinds |

|---|---|

| Strong corporate earnings | Elevated vaulations |

| Robust AI spending | Heavy mega-cap concentration |

| Potential fiscal stimulus | Tariff and policy uncertainty |

| Supportive monetary policy | Late-cycle positioning |

| Low recession probability | Geopolitical risk |

| Weaker dollar supporting multinationals | Inflation stickiness |

Artificial Intelligence: Investment Prospects and Risks

Artificial intelligence remains the dominant investment theme entering 2026, presenting both compelling opportunities and significant risks that warrant careful consideration. The AI narrative has driven extraordinary returns for a narrow cohort of technology leaders, but investors must now grapple with questions of sustainability, valuation, and the evolving landscape of beneficiaries.

The AI Valuation and Circular Investment Dynamics

AI-related equity valuations have reached levels reminiscent of the prior technology bubble, with market pricing embedding highly optimistic assumptions about revenue growth and margin expansion that may prove challenging to deliver. While demand for AI infrastructure and applications appears fundamentally sound, investors face the critical task of separating transformative technologies with sustainable competitive advantages from speculative momentum detached from business realities.

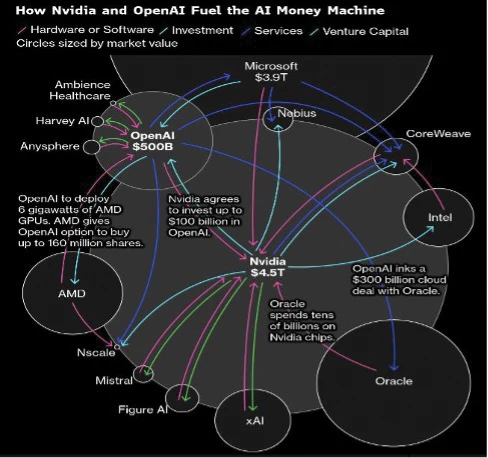

A growing concern is the circular investment architecture taking shape within the AI ecosystem. Complex cross-ownership arrangements between chipmakers and their largest customers may be distorting the sector’s true economics – when suppliers finance their clients who then commit to purchasing those same suppliers’ products, genuine third-party demand becomes difficult to distinguish from vendor-financed revenue. These feedback loops raise questions about whether current valuations reflect authentic end-user adoption or an interdependent financing structure vulnerable to unwinding if capital becomes scarce or performance disappoints.

Nvidia and AI Startups. Nvidia has emerged at the center of multiple circular financing arrangements with leading AI developers. The company agreed to invest up to $100 billion in OpenAI to help the AI startup fund a data center buildout, with OpenAI in turn committing to filling those sites with millions of Nvidia chips. The commercial relationships that accompany these investments raise questions about how much of Nvidia’s revenue growth reflects genuine third-party demand versus capital circulating within a network of affiliated companies.

AMD and Customer Warrants. Advanced Micro Devices has pursued a different but related strategy, issuing warrants to its biggest customers that give them equity upside in AMD’s success. OpenAI inked a partnership with AMD to deploy tens of billions of dollars’ worth of its chips, and as part of this arrangement, OpenAI is poised to become one of AMD’s largest shareholders.

Circular Investment Architecture with AI

These circular arrangements do not necessarily invalidate the AI investment thesis, but they do suggest that some portion of reported growth may prove less durable than headline figures imply. Investors should scrutinize the composition of AI-related revenues carefully and remain alert to the distinction between organic demand from the broader economy and capital circulating within a closed loop of technology companies.

Comparison to the Dot-Com Bubble

Despite surface-level similarities, current technology valuations are significantly lower and more strongly supported by fundamentals than those seen during the dot-com era. While absolute valuations are elevated relative to long-term averages, multiple metrics indicate the current environment is distinct from the speculative excess of the late 1990s and early 2000s.

Valuations are more rational. At the dot-com peak, Technology sector forward P/E ratios reached approximately 60 times earnings compared to around 33 times today, with the tech premium to the S&P 500 narrowing from 2.4 times to approximately 1.6 times.

Earnings and profitability are substantially stronger. The dot-com era featured profitless companies commanding extraordinary valuations, whereas today’s market leaders are enormously profitable enterprises with share prices driven by tangible earnings growth. Technology sector free cash flow margins currently stand near 20%, more than double late-1990s levels, with tech margins exceeding the broader S&P 500 by roughly 11 percentage points today versus only 2 percentage points in 1999.

Funding and balance sheets are considerably healthier. Unlike the debt-funded infrastructure build-out of the internet era, today’s hyperscalers such as Microsoft, Google, and Amazon are self-funding massive AI capital expenditures through operating cash flows. Despite nearly $1 trillion in AI-related investment, current Technology sector capital expenditures as a percentage of free cash flow remain well below dot-com era levels.

The magnitude of the current rally is more modest. The Nasdaq-100 returned over 900% in the five years leading to the dot-com crash, including a 102% surge in 1999 alone, whereas returns since ChatGPT’s late-2022 launch have been much closer to historical averages. Additionally, the necessary infrastructure for AI adoption – high-speed internet and smartphones – is already in place, allowing companies to immediately monetize AI applications and reducing the gap between investment and revenue realization that plagued the earlier technology cycle.

AI Accounting Considerations

As AI investments scale across corporations, accounting treatment has emerged as an area requiring scrutiny. AI equipment depreciation poses a major financial risk because rapid technological innovation creates significant risk that the useful life of these costly chips is being overstated in financial reporting, potentially leading to a large-scale reckoning.

Major technology companies have extended useful life estimates significantly in recent years. Meta Platforms increased estimated useful lives for servers and network assets to five and a half years from as little as three years in 2020, reducing depreciation expense by $2.3 billion in the first nine months of 2025. Alphabet and Microsoft extended depreciation periods from three years in 2020 to six years currently, while Amazon adjusted from four years to five years. These extensions boost current earnings by shifting expenses into the future, allowing management to increase annual earnings by billions with simple accounting estimate changes.

The risk stems from rapid technological obsolescence, as tech companies release more powerful chip models annually. There is no objective measure for how much a five-year-old processor is truly worth to an AI company. If equipment becomes obsolete in four years instead of the assumed five or six, companies face forced early purchases of new equipment and potential write-downs.

Concentration Risk

The concentration of AI-related returns in a handful of mega-cap technology companies represents a structural vulnerability for portfolios benchmarked to market-capitalization-weighted indices. Five stocks now account for a record 30% of the S&P 500’s total market capitalization, while the Magnificent 7 alone make up roughly 35% of the index. These companies now constitute an outsized share of major indices, meaning that idiosyncratic developments affecting even one or two names can have a disproportionate impact on overall market performance. This concentration creates correlation risk during periods of stress, as investors seeking to reduce AI exposure may find themselves selling overlapping positions simultaneously. The magnitude of this concern is reflected in the Natixis survey, where “concentration risk” is cited by 32% of institutions as a top portfolio risk for 2026. Prudent portfolio construction requires awareness of this dynamic and consideration of strategies to mitigate concentration risk.

Broadening AI Adoption: From Innovators to Enablers and Adopters

Looking ahead, AI adoption is expected to broaden significantly beyond the initial wave of innovators, primarily the technology giants that have dominated the AI narrative to date. The next phase of AI investment opportunity lies with the enablers: companies building the physical infrastructure required to support AI workloads, data center operators, networking equipment providers, and energy suppliers meeting the substantial power demands of AI computation.

Beyond the enablers, the adopters represent a third wave of potential beneficiaries. These are companies across diverse industries that are applying AI technology to transform their operations, enhance productivity, and create new products and services. Healthcare, financial services, manufacturing, and logistics are among the sectors where AI adoption is expected to accelerate, creating investment opportunities beyond the technology sector itself. This broadening of AI’s impact suggests that the investable universe of AI beneficiaries will expand considerably, potentially reducing concentration risk while opening new avenues for returns.

Stock Market Sector Outlook

Looking ahead to 2026, our top sector recommendations center on AI infrastructure enablers and deregulation beneficiaries. Utilities and Energy represent our highest-conviction positioning, transforming from defensive holdings into aggressive growth opportunities as data centers create unprecedented power demand. Financials are favored due to anticipated regulatory relief, improving net interest margins from yield curve steepening, and AI-driven operational efficiencies. Industrials offer compelling exposure through power equipment manufacturers and defense contractors, driven by both the physical build-out of AI infrastructure and rising European defense spending.

Technology may present opportunities, but stock selection will be paramount as the market broadens out from its historic concentration in the largest companies. As the earnings gap between mega-cap tech and the broader market narrows, investors should look beyond the dominant names to capture opportunities across the sector’s diverse landscape.

Healthcare warrants selective positioning given the sector’s mixed outlook—traditional pharmaceutical production faces margin pressures, but biotechnology and bioprocessing companies offer compelling opportunities driven by AI-powered drug discovery, digital transformation, and a resurgent mergers and acquisitions environment.

Small-cap stocks present a valuation opportunity at their most attractive relative levels in over two decades, particularly benefiting from rate cuts given their floating-rate debt profiles. On the underweight side, Consumer Discretionary faces headwinds from a bifurcated “K-shaped” recovery and potential tariff pressures, while office-focused Commercial Real Estate continues battling structural challenges from hybrid work adoption.

International Market Opportunities

Non-U.S. markets are looking more attractive from a valuation perspective, but sentiment is still correlated with the U.S. The weaker U.S. dollar provides a meaningful tailwind for international equities, while more moderate valuations offer potential upside relative to domestic counterparts. The performance of international stocks will depend significantly on currency dynamics, trade policy developments, and the relative pace of economic recovery across regions.

Investors should monitor global trade dynamics carefully, as the moderation in trade war tensions represents a key support for international equity performance. However, geopolitical developments can shift sentiment rapidly, requiring vigilant portfolio oversight. Diversification into international markets may provide both return enhancement and risk reduction benefits in a portfolio context, particularly given the valuation discount relative to U.S. equities.

Inflation Dynamics and Commodity Positioning

While we are not concerned with potential resurgence in high inflation, we expect cyclical factors such as resilient growth and tariff policy shifts, as well as structural factors including supply chain re-globalization, AI infrastructure spending, and trends toward energy independence, to keep inflation sticky. This persistent price pressure has important implications for asset allocation and portfolio construction.

Historically, commodities and gold have served as accretive portfolio diversifiers in eras of upside inflation surprise. Given current dynamics, investors may consider hedging inflation and geopolitical risk with allocations to both gold and commodities. An allocation to gold, precious metals, and industrial metals may provide meaningful portfolio protection while maintaining exposure to economic growth.

Currency Debasement and the Rise of Gold

The recent volatility in precious metals markets is heavily influenced by the debasement trade, driven by fears that major governments are systematically eroding the value of their currencies through massive money printing, persistent deficit spending, and artificially low interest rates. This narrative has been a primary driver of gold’s spectacular surge, which saw the metal rise 59.95% year-to-date as of December 5. Gold has emerged as the primary beneficiary because it is a real asset whose value derives from utility and scarcity rather than future cash flows anchored to a currency. When the currency weakens, the price of the real asset rises in nominal terms – revealing that while the S&P 500 is up in U.S. dollar terms, it is actually down approximately 20% when priced in gold.

Central banks themselves have become significant buyers of gold, with recent data suggesting gold has surpassed U.S. Treasuries as a percentage of global central bank reserves. This historic shift reflects a desire to diversify away from the U.S. dollar due to geopolitical concerns and reflects a broader loss of confidence in sovereign creditworthiness. However, some analysts question whether currency erosion fully explains current market dynamics, pointing to inconsistencies such as slowing real estate growth and the outperformance of speculative AI stocks over traditional inflation hedges like consumer staples. Gold’s rise likely reflects a combination of factors beyond pure debasement fears, including momentum trading, geopolitical hedging, and institutional portfolio rebalancing.

Geopolitical Risk and Portfolio Hedging

Geopolitical shocks have become more frequent, challenging the traditional assumption that U.S. Treasury securities and the dollar provide unconditional protection during periods of global stress. Market sentiment and hedging behavior can shift rapidly in response to policy announcements or global events, underscoring the importance of robust risk management frameworks. Given this environment, investors should consider hedging inflation and geopolitical risk with both gold and commodities allocations. Gold and precious metals serve as stores of value during periods of uncertainty, while industrial metals provide exposure to global growth and infrastructure investment, creating a diversified approach that may protect portfolios against adverse scenarios while maintaining upside participation.

Fiscal and Monetary Policy Convergence

In 2026, the impact of monetary and fiscal policy on equities is characterized by a complex interplay of supportive stimulus and lingering constraints. The environment features pro-growth fiscal measures and a slow easing of interest rates that generally support equity risk assets, though this is counterbalanced by inflationary pressures from tariffs and elevated government debt levels. Understanding these dynamics across regions is essential for positioning portfolios effectively.

United States: The OBBBA and the Fed’s Delicate Balance

The U.S. outlook for 2026 is defined by a unique mix of loosening monetary policy and aggressive fiscal stimulation. The One Big Beautiful Bill Act, commonly referred to as the OBBBA, represents a dominant theme and is expected to be a significant tailwind for equities. This legislation provides for full expensing of equipment and research and development spending, allowing businesses to accelerate depreciation of capital expenditures. Additionally, it includes tax breaks for households such as eliminating taxes on overtime pay, tips, and car loan interest, measures expected to boost disposable income and consumer demand.

The economic impact of these measures is substantial. Projections suggest the OBBBA will inject roughly $100 billion of additional stimulus into the economy between January and April 2026 through enhanced tax refunds. This fiscal lift is expected to neutralize the contractionary drag of higher tariffs, providing a net positive impulse to economic activity. For corporations, the return of 100% capital expenditure depreciation is expected to pull forward business investment, supporting corporate profitability and potentially extending the earnings cycle.

On the monetary policy front, the Federal Reserve is expected to continue cutting rates, but the pace and depth remain subjects of debate given the inflationary pressures generated by fiscal stimulus. The Market anticipates the Fed to reduce rates two times in 2026, representing a gentle or shallow easing cycle rather than aggressive cuts, aimed at returning policy to a neutral stance. The inflationary impact of both tariffs and the OBBBA stimulus will prevent the Fed from cutting aggressively, placing policymakers on the hot seat as they balance growth support against price stability.

A non-recessionary rate-cutting cycle is historically constructive for U.S. earnings and equity performance. It specifically supports small-cap stocks, which are more sensitive to domestic economic growth and financing costs. As borrowing costs decline and fiscal stimulus flows through the economy, smaller companies with greater domestic revenue exposure and higher leverage to interest rate changes stand to benefit disproportionately.

Fixed Income

The fixed income landscape as 2026 approaches is being defined by four interrelated forces: the Federal Reserve’s shift to a more cautious easing approach following its December 10th meeting, a potential steepening of the Treasury yield curve, an ongoing structural re-pricing of relative safety between corporate and sovereign debt, and a discernible deterioration in consumer credit quality. The Fed will remain the primary driver of short-term rate direction while exerting meaningful influence over longer-dated securities. Concurrently, investors are confronting a market environment in which traditional assumptions about the security of government obligations are being reassessed, even as increasing consumer credit stress signals mounting financial vulnerability among lower-income households.

Within this evolving context, investors may want to consider shifting away from broad-market fixed income exposure and toward a strategy driven by flexibility, active management, and an emphasis on income generation rather than capital appreciation.

Federal Reserve Policy and Treasury Yields

Rate Cut Expectations

At its December 10, 2025 meeting, the Federal Reserve delivered a quarter-point rate cut, bringing the target range to 3.5%-3.75%. However, the updated dot plot reveals a significant deceleration in the easing cycle, with the median Fed official projecting only one additional quarter-point cut in 2026. This marks a transition from consistent easing to a more cautious “wait-and-see” approach, with the committee deeply divided: seven officials favor holding rates steady throughout all of 2026, while eight support at least two cuts.

The post-meeting statement emphasizes the “extent and timing” of future adjustments will depend on the economic outlook, setting a higher threshold for additional cuts. This language shift suggests rates may remain near current levels longer than previously anticipated. Meanwhile, interest-rate swap traders continue to price in roughly two quarter-point reductions for 2026, diverging from the Fed’s median projection and underscoring the potential for market volatility as expectations adjust to incoming data.

Upgraded Economic Outlook

Policymakers sharply upgraded their economic projections at the December meeting, forecasting 2026 GDP growth at 2.3%, up from the 1.8% projected in September. Chair Powell noted that some of this upgrade represents growth shifting from 2025 to 2026 due to federal government shutdown distortions. The median inflation forecast for year-end 2026 was lowered slightly to 2.4% from 2.6%, though this remains above the 2% target. Powell warned that the peak impact of tariffs on inflation is expected to occur in the first quarter of 2026 before subsiding in the second half.

Ten-Year Treasury Dynamics

Following the December meeting, Treasury yields drifted lower, with the 10-year rate falling to approximately 4.15% and the policy-sensitive two-year yield dropping about five basis points to 3.56%. While this represents near-term relief, the 10-year continues to face resistance around the 4.0% level. Stronger growth forecasts and persistent inflation above target suggest limited downside for longer-dated yields.

Fed easing in the first half of 2026 is expected to put downward pressure on yields initially, but the ten-year yield is projected to rise once the easing cycle ends. Bloomberg Intelligence anticipates the ten-year to finish 2026 closer to 4.5% than 4.0%, reflecting persistent deficit spending and increased expectations of future rate hikes. The challenging fiscal backdrop, marked by high debt levels and large budget deficits, raises the risk of deeper selloffs and implies that rallies in longer-dated Treasuries are likely to be limited.

Yield Curve Steepening Forecast

If current trends hold, the Treasury yield curve may steepen more than markets expect, with the two-year to ten-year spread projected to exceed 100 basis points by end-2026. In early 2026, labor market weakness and additional rate cuts could drive short-term yields lower, while later in the year the curve may shift to bear steepening as long-term yields rise on deficit and inflation concerns.

Political risks add to this dynamic, as uncertainty over Federal Reserve independence – especially the potential appointment of more dovish policymakers – pushes longer-term yields higher amid doubts about the Fed’s inflation-fighting ability.

Chair Powell’s term ends in May 2026, and the transition to a new Fed chair introduces policy uncertainty that could drive market volatility.

Federal Reserve Balance Sheet Operations

The Federal Reserve’s quantitative tightening program concluded on December 1, marking the end of its journey from abundant to ample reserve conditions. At its December 10 meeting, the Fed announced it will begin buying $40 billion of Treasury bills per month starting December 12, 2025. Officials emphasized this is not Quantitative Easing or a stimulus measure, but rather a technical operation to maintain “ample” reserve balances in the banking system, which had declined to levels requiring intervention.

These purchases are expected to remain elevated for a few months – specifically through the April tax season – to manage liquidity pressures before decelerating. This creates extra demand for short-term Treasuries, which should improve liquidity in overnight markets and help stabilize short-term yields, even though the outlook for longer-term bonds remains uncertain. Total annual Treasury purchases to maintain ample reserves are expected to be less than $200 billion per year, with purchases primarily focused on Treasury bills.

This Fed buying program represents just one of several forces reinforcing demand for short-term Treasuries. The central bank is expected to keep rolling over $200 billion in mortgage-backed securities prepayments into Treasury bills, ensuring additional steady bid support. At the same time, the Treasury’s issuance strategy favors short-term bill sales over long bonds, arguing it is not cost-effective to lock in elevated yields on longer maturities.

A new source of demand is also emerging from the stablecoin sector. Because stablecoins are typically backed by liquid assets like Treasuries, their rapid growth could generate roughly $500 billion in annual bill demand. Combined with the Fed’s technical purchases and mortgage-backed security (MBS) reinvestment, these multiple demand streams position the short end of the curve to benefit from structural support. This trend is expected to support liquidity in overnight funding markets and potentially stabilize the very front end of the yield curve even as uncertainty clouds the path for longer-dated bonds, keeping short-term rates relatively low and sustaining consistent demand for government debt.

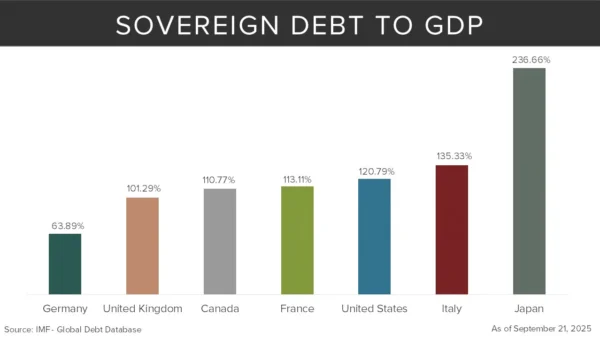

Sovereign Risk

A major structural shift is underway as investors increasingly view high-quality corporate bonds as safer than sovereign government debt, with companies like Microsoft, Airbus, L’Oreal, Siemens, and LVMH now trading at yields near or below their home countries’ bonds. Corporate executives have responded to higher interest rates with fiscal discipline, reducing net debt-to-EBITDA from 2.53 a decade ago to 1.74, driving the fastest pace of credit upgrades in ten years – Microsoft exemplifies this with a triple-A rating and net debt at just one-tenth of earnings.

In contrast, G-7 countries (U.S., Canada, France, Germany, Italy, Japan, and the United Kingdom) show little fiscal restraint, with debt-to-GDP ratios projected to reach 137% by 2030 and the U.S. deficit expected to remain above 6% for the current presidential term, triggering downgrades for countries including the U.S. and France. This divergence has narrowed the corporate-sovereign spread to its lowest level since 2007, though corporate bonds remain less liquid and carry higher risk premiums at longer maturities, indicating their long-term creditworthiness still lags government benchmarks despite near-term advantages.

Consumer Credit Distress

Financial stress among lower-income borrowers is becoming more visible, especially in auto loans and housing. Rising inflation and the restart of student loan payments are adding pressure. In October, 6.65% of subprime auto borrowers were at least 60 days behind on payments, the highest level since 1994.

Mortgage delinquencies are also climbing. Among loans more than 90 days overdue, over 12% of homeowners could not be contacted by their lender, nearly double the rate from the second quarter. The main reasons for these long-term delinquencies are reduced income, heavy debt burdens, and unemployment, with the latter two at their highest levels in at least five years. On the positive side, average 30-year fixed mortgage rates have eased slightly to 6.23%.

Federal Reserve Independence and Market Implications

The fixed income outlook is increasingly influenced by concerns over Federal Reserve independence. Political pressure on monetary policy directly impacts inflation expectations, yield curve dynamics, and the risk premium demanded by investors. Financial markets are taking the threat to Fed independence seriously, as evidenced by elevated volatility and shifting rate expectations.

Speculation over the future of Fed Chair Jerome Powell, combined with ongoing criticism from the administration, has driven a broad increase in risk premiums. The potential nomination of candidates viewed as favoring deeper rate cuts has steepened the yield curve, as markets see such appointments tilting the Federal Open Market Committee (FOMC) too dovish. This raises concerns about the Fed’s credibility in fighting inflation and adds upward pressure to longer-term yields.

Key Fed Composition Dates: February-March 2026

February 2026 marks a pivotal moment for potential changes in Federal Reserve leadership. Atlanta Fed President Raphael Bostic will retire at the end of his term, removing one of the FOMC’s most centrist voices. At the same time, the twelve regional Federal Reserve Bank presidents face their five‑year reviews, with the Board of Governors required to vote on reappointments by March 1.

Although this process has traditionally been routine, the White House has signaled it may use the reviews to influence FOMC composition. On January 21, the Supreme Court will hear arguments on Governor Lisa Cook’s attempted removal. If President Trump succeeds in replacing Cook and filling other vacancies, his appointees could hold a majority on the Board of Governors, giving them the power to block reappointments of Reserve Bank presidents. Such moves could fundamentally reshape the committee and tilt it toward a more dovish stance.

Investment Strategy Recommendations

Investors may consider reducing exposure to broad-market fixed income in favor of a more flexible, actively managed strategy that emphasizes income generation over capital gains. Supporting this view, 71% of institutional investors surveyed by Natixis believe active management will be essential in 2026, as markets contend with conflicting signals from inflation data and central bank policy.

The Fed’s December meeting reinforces this approach. With deep internal divisions, diverging market expectations, and a “wait-and-see” stance replacing systematic easing, fixed income markets face heightened uncertainty and potential volatility throughout 2026.

Duration Management: A Critical Imperative

Duration management is now seen as essential rather than optional, given a steepening yield curve shaped by conflicting monetary and fiscal forces. Analysts warn against taking on too much duration risk, noting that long-term rates are likely to stay elevated even as short-term rates decline. Investors are encouraged to manage duration carefully, balancing protection from higher long-term yields with opportunities from short-term rate cuts.

Portfolios positioned modestly short of benchmark duration can reduce sensitivity to rate moves without sacrificing returns. Short-duration, higher-yielding securities provide income, risk mitigation, and liquidity, though relying solely on them may limit yield. We therefore recommend a barbell strategy: combining short-dated instruments that benefit from Fed cuts with select intermediate maturities to capture policy advantages while limiting exposure to long-end volatility.

Passive duration strategies are considered particularly risky in today’s environment. With rate volatility likely to intensify as markets reassess the Fed’s response to sticky inflation and shifting conditions, a flexible, diversified, and actively managed approach is viewed as critical to navigating uncertainty.

Sector Allocation: Beyond Standard Corporate Bonds

Investors may benefit from looking beyond traditional corporate bonds, which many managers see as expensive given tight credit spreads. In below‑investment‑grade markets, short‑duration high yield offers a balance of income and volatility control, while securitized bank loans provide attractive risk‑reward through floating‑rate coupons and senior positioning in the capital structure.

Securitized credit also deserves attention. Mortgage‑backed securities and similar structures often deliver stronger credit protection and higher‑quality collateral than many investment‑grade corporates. As central banks cut policy rates, declining cash yields should further enhance the appeal of these higher‑yielding segments.

Municipal bonds present another opportunity, supported by solid fundamentals and favorable technicals. Taxable municipals, in particular, allow exposure to infrastructure financing and often compensate investors more effectively for duration risk than corporates. By keeping corporate credit exposure shorter and extending duration in municipals or infrastructure debt, investors can capture better risk premiums and structural protections.

Global Diversification Opportunities

Diverging central bank policies are opening opportunities abroad. In emerging markets, rate cuts and a weaker dollar boost local debt appeal, while in Europe, faster disinflation gives the European Central Bank more room to ease. Together, high‑quality emerging markets and European bonds offer yield and diversification beyond U.S. markets.

Fixed Income as a Portfolio Diversifier

Recent market moves have reaffirmed Treasuries as a reliable stock market diversifier during risk-off periods. Long-dated bonds continue to provide downside protection, easing concerns about their safe haven role that surfaced during summer volatility. This traditional correlation has held even as other hedges have weakened. By contrast, gold has lost its negative correlation to equities and is behaving more like a risk asset, with price action reflecting market risk premiums rather than serving purely as a defensive allocation.

Conclusion

The 2026 investment landscape presents a complex but navigable environment shaped by supportive monetary policy, evolving fiscal dynamics, and persistent structural shifts across asset classes. The U.S. economy remains on a path of moderate expansion, supported by stable labor markets, ongoing AI infrastructure investment, and anticipated fiscal stimulus from the OBBBA, though housing continues to face headwinds and a pronounced K-shaped recovery masks financial strain among lower-income households.

In equities, a supportive global policy backdrop and strong corporate earnings provide a foundation for continued opportunity, particularly as AI adoption broadens beyond mega-cap technology leaders to enablers and adopters across diverse sectors. Our highest-conviction sector positioning centers on Utilities, Energy, Financials, and Industrials as AI infrastructure enablers and deregulation beneficiaries. However, elevated valuations, concentration risk in the Magnificent 7, and circular investment dynamics within the AI ecosystem warrant disciplined portfolio construction. Small-cap stocks may offer compelling value, with their floating-rate debt profiles positioning them to benefit disproportionately from Fed rate cuts, while Consumer Discretionary and office-focused Commercial Real Estate face structural headwinds that justify underweight positioning.

Fixed income markets are undergoing a structural realignment as investors reassess traditional assumptions about credit safety. High-quality corporate bonds increasingly compete with sovereign debt as disciplined corporate balance sheets contrast sharply with elevated government deficits projected to remain above 6%. The Federal Reserve’s shift to a cautious “wait-and-see” approach, combined with deep FOMC divisions, creates uncertainty around the rate path for 2026. While Fed easing should support front-end performance early in the year, the 10-year Treasury yield is expected to drift toward 4.5% by year-end as deficit spending and inflation concerns pressure long-term rates. Active duration management and flexible sector allocation will be essential, with a barbell strategy combining short-dated instruments with select intermediate maturities offering an effective approach to navigate the steepening yield curve.

Key risks to monitor include concentration in mega-cap technology stocks, tariff and trade policy uncertainty, potential erosion of Federal Reserve independence as Chair Powell’s term ends in May 2026, and rising consumer credit distress among lower-income borrowers. The transition in Fed leadership and regional bank president reviews in February-March 2026 introduce policy uncertainty that could drive market volatility.

Investors who maintain diversified portfolios, remain nimble in response to shifting conditions, and adapt their frameworks to account for evolving risks will be best positioned to navigate 2026’s crosscurrents and capitalize on opportunities across asset classes. The year ahead may reward active management, selective sector exposure, and robust risk management as the investment environment continues to evolve.

Economic Outlook Summary 2026

Economy

Positives

- Federal Reserve easing with accommodative monetary policy

- Labor market stable with 4.4% unemployment rate

- Job openings exceed 7 million

- Manufacturing investment supported by AI infrastructure spending ($500B+)

- Consumer spending resilient with strong holiday performance

- Fiscal stimulus expected from OBBBA tax measures

Negatives

- Late economic cycle positioning

- Layoffs broadening across multiple segments

- Consumer confidence declining (88.7 in November)

- K-shaped recovery: wealthiest 10% driving nearly half of spending

- Housing market weak with affordability challenges

- Tariff uncertainties persist and disrupt trade

- Inflation sticky above Fed’s 2% target

The U.S. economy enters 2026 navigating a complex landscape shaped by diverging sector performance and evolving policy dynamics. While the labor market remains stable and AI infrastructure spending provides a solid foundation, a pronounced K-shaped recovery masks financial distress among lower-income households. The Federal Reserve is expected to continue easing, though the pace remains uncertain given sticky inflation. Manufacturing shows stabilization supported by AI-related investments, while housing continues to face headwinds from elevated prices and borrowing costs. Consumer spending demonstrates resilience among upper-income households, but confidence among the broader population remains subdued. The outlook suggests continued moderate expansion with elevated volatility.

Bonds

Positives

- Federal Reserve easing cycle supports front-end yields

- High-quality corporate bonds increasingly viewed as safer than sovereigns

- Strong corporate credit fundamentals (net debt-to-EBITDA at 1.74, down from 2.53)

- Treasury bill demand supported by Fed purchases and stablecoin growth

- Municipal bonds supported by solid fundamentals

Negatives

- Yield curve expected to steepen; long-end yields face upward pressure

- FOMC deeply divided: 7 favor holding, 8 support at least two cuts

- Sovereign fiscal risk elevated with deficits above 6%

- Fed independence concerns adding term premium uncertainty

- Consumer credit distress rising (6.65% subprime auto delinquencies)

- Duration risk requires active management

The fixed income landscape for 2026 is defined by the Federal Reserve’s shift to a cautious easing approach, with deep FOMC divisions creating uncertainty around the rate path. The 10-year Treasury yield is expected to drift toward 4.5% by year-end as long-term rates face upward pressure from deficit spending and inflation concerns. A structural shift is underway with investors increasingly viewing high-quality corporate bonds as safer than sovereign debt. Corporate fiscal discipline has driven the fastest pace of credit upgrades in ten years, while G-7 governments show little restraint. Investors should consider reducing broad-market fixed income exposure in favor of flexible, actively managed strategies emphasizing income generation and careful duration management.

Stocks

Positives

- Strong corporate earnings with 83% of S&P 500 beating Q3 estimates

- AI adoption broadening beyond mega-cap tech to enablers and adopters

- Accommodative global monetary policy environment

- Fiscal stimulus from OBBBA expected to boost cyclical sectors

- International markets offer attractive valuations and dollar weakness tailwind

- Small-cap stocks at most attractive relative valuations in over two decades

Negatives

- Elevated valuations with forward P/E at 22.4 (above 5-year avg of 19.9)

- Heavy concentration in Magnificent 7 creates idiosyncratic risk

- Circular AI investment dynamics raise questions about sustainable demand

- AI equipment depreciation and accounting concerns

- Late-cycle positioning with narrowing margin for error

- Tariff and geopolitical risks remain elevated

Equity markets face competing forces of strong corporate earnings and broadening AI adoption against elevated valuations and significant concentration risk in mega-cap technology stocks. The AI investment theme remains dominant but warrants scrutiny given circular investment dynamics between chip makers and their largest customers. Unlike the dot-com era, today’s technology leaders are enormously profitable with much stronger balance sheets. International markets may offer attractive opportunities supported by a weaker dollar and more moderate valuations. Small-cap stocks present a compelling valuation opportunity at their most attractive relative levels in over two decades, particularly benefiting from rate cuts given their floating-rate debt profiles. Gold has emerged as a key portfolio diversifier amid currency debasement concerns and geopolitical uncertainty.

For Investors

Equities

- Opportunities may persist amid supportive earnings and policy conditions, though elevated valuations warrant discipline Top sector recommendations: Utilities, Energy, Financials, and Industrials as AI infrastructure enablers and deregulation beneficiaries

- Look for AI adoption to broaden from innovators to enablers and adopters across diverse sectors

- Technology stock selection paramount as market broadens beyond mega-cap concentration

- International equities attractive with valuation discount and dollar weakness tailwind

- Small-caps positioned to potentially benefit from rate cuts and attractive relative valuations

- Consider hedging inflation and geopolitical risk with gold and commodities allocations

- Underweight Consumer Discretionary and office-focused Commercial Real Estate

Fixed Income

- Reduce exposure to broad-market fixed income in favor of flexible, active management

- Duration management essential given expected yield curve steepening

- High-quality corporate bonds may offer better risk-reward than sovereign debt

- Short-duration, higher-yielding securities provide income and volatility control

- Municipal bonds present opportunity with solid fundamentals

- Emerging market and European bonds offer diversification as central banks diverge

- Consumer credit deterioration warrants caution in lower-quality segments

Disclosure

This information is of a general nature and does not constitute financial advice. It does not take into account your individual financial situation, objectives or needs, and should not be relied upon as a substitute for financial or other professional advice to assess, among other things, whether any such information is appropriate for you and/or applicable to your particular circumstances. In addition, this does not constitute an offer to sell, or the solicitation of an offer to buy, any financial product, service or program. The information contained herein is based on public information we believe to be reliable, but its accuracy is not guaranteed.

Investing involves risks, including loss of principal. Past performance is no guarantee of future results.

Definitions

*Basis Point: one hundredth of one percent, used chiefly in expressing differences of interest rates.

*Debt-to-GDP Ratio: compares government debt to GDP, indicating a country’s ability to repay its obligations.

*Price/Earnings Ratio: ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

*Growth: A company stock that tends to increase in capital value rather than yield high income.

*NASDAQ: is a global electronic marketplace for buying and selling securities.

*Net Debt-to-EBITDA: measures leverage by dividing net interest-bearing debt (debt minus cash) by EBITDA.

*The Purchasing Managers’ Index (PMI) is an indicator of the prevailing direction of economic trends in the manufacturing and service sectors. The indicator is compiled and released monthly by the Institute for Supply Management (ISM), a nonprofit supply management organization.

*Quantitative Easing (QE): a monetary policy where a central bank injects money into the economy to artificially stimulate economic activity.

*Quantitative Tightening: monetary policies that contract, or reduce, the Federal Reserve System (Fed) balance sheet.

*Russell 2000 Index: a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index.

*S&P 500 Index: S&P (Standard & Poor’s) 500 Index: is a market-capitalization-weighted index of the 500 largest US publicly traded companies.

*Value: A value stock is a security trading at a lower price than what the company’s performance may otherwise indicate.

*Yield Curve: A yield curve is an economic indicator that tracks the relationship between long- and short-term bond yields.

*Indexes are not managed. One cannot invest directly in an index.

This material is distributed by James Investment Research, Inc. and is for information purposes only. No part of this document may be reproduced in any manner without the written permission of James Investment. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are the opinions of James Investment and are subject to change without notice. James Investment assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. Past performance is not indicative of future results. All rights reserved. Copyright © 2025 James Investment.