When it comes to philanthropy, timing matters. The decision of when and how much to give isn’t just about generosity, it’s also about strategy. With the passage of the One Big Beautiful Bill Act (OBBBA), 2025 represents a particularly opportune time to evaluate your charitable giving. The legislation made many of the tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) permanent. While there are lots of benefits to the bill, some of the provisions are not favorable to charitable gifting. Stay tuned to learn about the opportunities in 2025 that are headwinds in 2026 as well as a new benefit for 2026 and beyond.

The Charitable Deduction Changes Under OBBBA

OBBBA introduces three pivotal changes to charitable deductions that will take effect in 2026:

1. Cap on Itemized Deductions for High-Income Earners

Starting in 2026, individuals in the 37% federal income tax bracket will experience a reduction in the tax benefit of their itemized deductions, including charitable contributions. Specifically, the benefit will be capped at 35% of the amount deducted. This means that for high-income earners, the tax advantage of charitable giving will decrease, reducing the overall incentive to contribute.

2. 0.5% AGI Floor for Charitable Deductions

Also commencing in 2026, charitable deductions will only be allowed to the extent that the total amount of charitable contributions exceeds 0.5% of the taxpayer’s adjusted gross income (AGI). For instance, if your AGI is $300,000, the first $1,500 of charitable donations would not be deductible. This threshold effectively increases the cost of charitable giving for taxpayers who itemize their deductions.

3. New charitable contribution deduction for non-itemizers

Taxpayers who do not itemize will be able to deduct up to $1,000 in cash donations, or $2,000 for married couples filing jointly. This permanent provision is not indexed for inflation and excludes donations to donor-advised funds or private foundations.

Why 2025 Presents a Unique Opportunity for High Income Taxpayers

The first two changes make 2025 stand out as an optimal year for high-net-worth individuals to consider making substantial charitable contributions. Front-loading charitable contributions can be part of a broader tax strategy, potentially offsetting other taxable income and reducing your overall tax liability. By accelerating donations into 2025, you can:

- Maximize the Tax Benefit: Contributions made in 2025 will be subject to the current, more favorable deduction rules, allowing you to receive a higher tax benefit compared to future years.

- Avoid the 0.5% AGI Floor: Donations made in 2025 will not be subject to the new 0.5% AGI floor, enabling you to deduct a larger portion of your charitable contributions.

Donor Advised Funds (DAFs) are a vehicle that can be used to bunch charitable contributions for multiple years. DAFs allow you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants to your chosen charities over time. This flexibility can be particularly beneficial in accelerating the timing of your charitable giving into 2025.

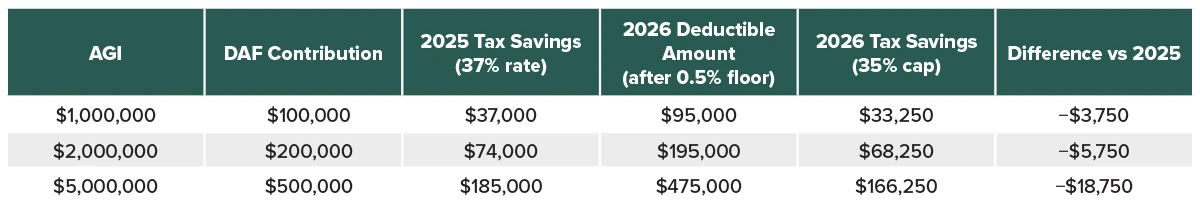

For example, imagine a donor with 2025 income of $1 million. If they contribute $100,000 to a DAF in 2025, they can reduce their income by the full amount under the current rules. At a top federal tax rate of 37%, this could reduce federal income taxes by approximately $37,000.

Looking ahead to 2026, the 0.5% AGI floor reduces the deductible portion by $5,000, and the 35% effective cap limits the tax benefit to $33,250. The combined effect of these rules reduces tax savings by $3,750. Larger contributions follow the same pattern, the higher the contribution and AGI, the greater the potential tax erosion if giving is delayed.

DAF Contribution Tax Savings, 37% Bracket

These examples illustrate that by contributing to a DAF in 2025, donors can maximize both their charitable impact and the associated tax benefit, while retaining the flexibility to grant funds to charities over several years. Waiting until 2026 would reduce the tax efficiency of the gift due to the combined effect of the 0.5% floor and the 35% cap.

New Benefit in 2026 for Taxpayers Who Don’t Itemize

While 2026 presents reduced charitable deductions for high income taxpayers, there is a new benefit everyone can enjoy. OBBBA provides a charitable giving tax benefit even if the donor takes the standard deduction, expanding the benefit of charitable giving to more taxpayers.

Key details of this new provision include:

- Deduction Limits: Up to $1,000 for single filers and $2,000 for married couples filing jointly.

- Permanent Provision: This deduction is permanent, though the maximum amounts are not indexed for inflation.

- Eligible Contributions: Only direct cash gifts to qualified public charities qualify. Donations to donor-advised funds, private foundations, or other entities do not qualify.

- Above-the-Line Deduction: Because it is claimed above the line, taxpayers benefit even if they take the standard deduction, effectively lowering their taxable income directly.

This provision ensures that all taxpayers, not just those who itemize, can benefit from charitable giving, making 2026 a good year to contribute even if you won’t itemize your deductions.

Conclusion

Philanthropy is most powerful when generosity and foresight intersect. The OBBBA has created opportunities in 2025 and 2026 for individuals to give more and deduct more.

- Itemizers still gain the largest tax benefit, but new limitations in 2026 reduce the effective deduction for high-income taxpayers.

- Non-itemizers now have a meaningful incentive to give, with an above-the-line deduction that reduces taxable income even if they take the standard deduction.

- Even small contributions can yield direct tax savings, encouraging broader participation in charitable giving.

By aligning your strategy with this unique moment in tax law, you can do well for yourself, your family, and the world around you.

Turn Generosity Into Strategy

Work with James Investment to create a charitable giving plan that supports the causes you care about while strengthening your overall wealth plan. Learn more today.