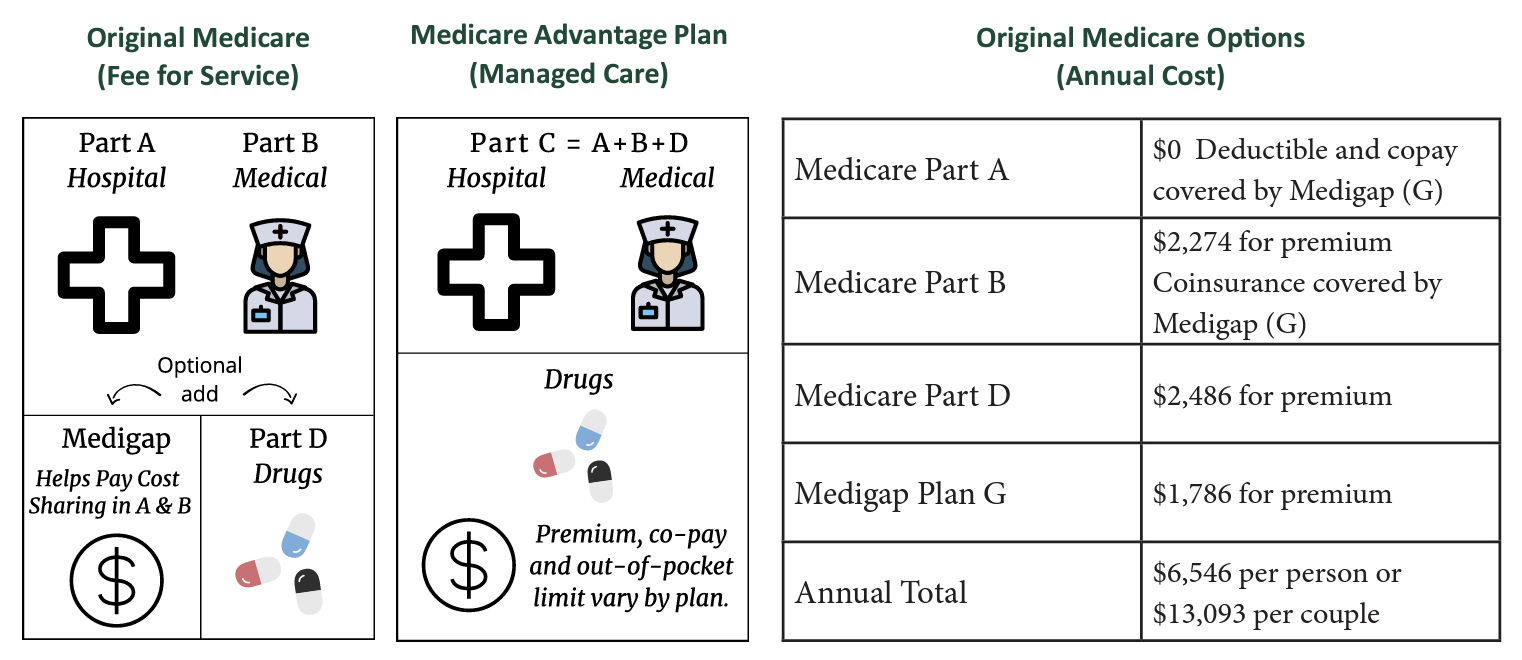

There is so much information about Medicare out there, the following information should help to clarify. First let’s look at a quick synopsis of the Medicare parts; there are two different paths to take with Medicare.

A common misnomer that people have is that Medicare will cover all medical costs. There are several layers of cost with Medicare: premiums, deductibles, co-insurance and copays. For Medicare Part A, hospitalization coverage, there is no premium because of paid payroll tax on your earnings while working. But, there are deductibles and copays depending on the length of a hospital stay. For Part B, out-patient medical insurance, there is a premium each month that can change from year to year. Just like medical insurance while working, there are deductibles, coinsurance, and copays for doctor’s visits or lab work. Part D (D is for drugs) like Part B has a changeable monthly premium, copays, and deductibles also very similar to prescription coverage while working.

On the original Medicare path, one would get Part A and B and then might purchase a Medigap plan and Medicare Part D. Medigap plans are also known as Medicare supplements. Medigap Plan G charges a monthly premium and then covers any copays or coinsurance required by Medicare Part B and covers copays, deductibles, and coinsurance required by Part A. Medigap Plan G is very popular because the only extra out of pocket cost is the $233 deductible for Part B. Medigap plans do not supplement any deductibles, copays, or coinsurance for Part D. Some retirees may be able to use their retiree medical coverage as a Medigap plan.

On the Medicare Advantage Plan path, the premium for Part B and provides coverage for Parts A and B. The most popular Medicare Advantage Plans charge $0 for Part C, the average Part C plan in Ohio is $47/month. Part C normally provides some Medigap and Part D coverage. There are many different types of Medicare Advantage plans available that have varying providers, copays, deductibles, or co-insurance. It is important to research the right Part C plan to minimize out of pocket costs. The cheapest Part C plans are like Health Maintenance Organizations (HMOs), coverage is extended to only a select group of providers. That is the biggest disadvantage. Cost and coverage are very dependent on whether the doctors are in-network. So before selecting a plan, check the in-network doctors to ensure the best coverage.

If travel is part of retirement, the free Medicare Advantage Plans might fall apart. Most plans cover emergency room or urgent care coverage for an accident while traveling. Selecting a plan that has a travel benefit will provide coverage to see a regular doctor while out of network. Those plans act more like PPO coverage and might cost more per month. Some Medicare Advantage Plans also provide other benefits such as dental and vision coverage that original Medicare doesn’t. Is your head spinning yet? This is very confusing. Reach out to a professional.

At James we have a list of professional resources that will point clients in the right direction. They are companies that will review medical conditions and prescriptions to determine whether it makes sense to go the original Medicare or the Medicare Advantage Plan route. They’ll help navigate the variety of options available. Most people are surprised to find out that this service is free. It is free because the professional is compensated by the Medigap or Medicare Advantage Plan that is selected.

Another thing we like to do for our clients is an analysis of which route makes the most sense given their financial goals. Healthcare in retirement is very expensive. It is common to worry if paying for healthcare as well as the other goals in retirement is feasible. This concern is part of a wealth management discussion we would have with you. At James, we want our clients to feel confident in their retirement.

– The James Team

If you have questions or would like help with your strategy, contact our Wealth Management team.