March 2023

Key Insights

- Disconnect between the equity and bond market appreciation of the Federal Reserve interest rate path.

- A resilient labor market and rising consumer spending may keep inflation elevated for longer.

- Earnings deterioration and more Fed tightening are not priced in the market for 2023.

- The late phase in the business cycle may require a more defensive posture.

Monthly Recap

After a treacherous 2022, financial markets had a good start in 2023. However, the January rally stalled at the beginning of February after the January job report showed an economy creating jobs faster than population growth. Economic data released in February also showed the highest retail sales growth in two years, powered by the highest ratio of vacancies to unemployed in a long time. Hence, the economy’s resilience surprised many and called for a “higher for longer” interest rate regime by the datadependent Federal Reserve (Fed).

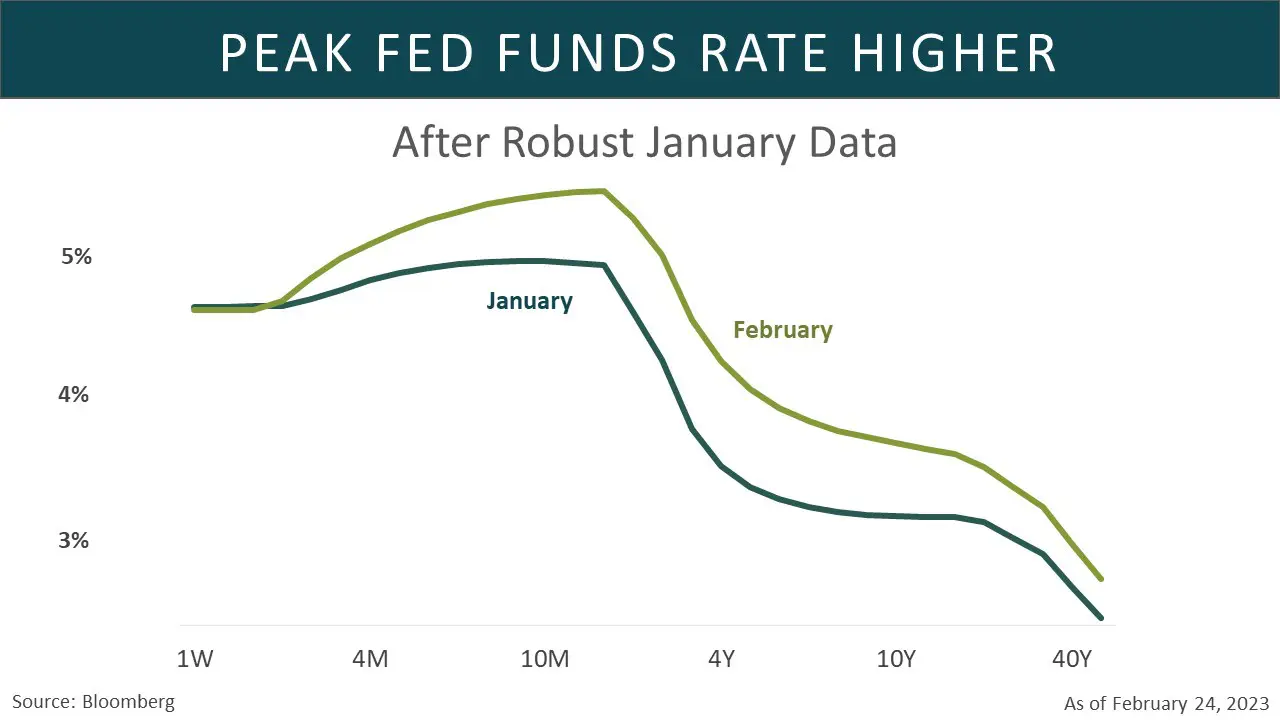

Bonds of all maturities sold off in February, with yields coming back up to reflect the higher for longer scenario. Bond prices go down when yields go higher. Additionally, the market pricing for the terminal/peak Fed funds rate has increased by over 60 basis points or 0.6% since February 2nd. The Fed is expected to increase the Fed funds rate by 25 basis points in each of the next three meetings (March, May, and June). The two-year U.S. Treasury yield, the most sensitive maturity to Fed policy, is back at 4.8% after being close to 4% at the end of January.

After the hot streak of economic data, Fed officials have ramped up their hawkish rhetoric, saying their inflation flight is not done yet and a 50-basis point hike in March should come back into consideration if economic data continues to surprise to the upside. In our view, the Fed may have to hike more than currently priced in and hold the terminal rate for longer as the economy continues to show its resilience and inflation remains stubbornly higher than the Fed’s 2% target through year-end.

On the other hand, while the bond market finally got the Fed’s message on rates, stocks continued to ignore it for the most part. For most of 2022, rising rates led to declining stock prices. For example, the brutal repricing in the two-year Treasury note would imply a 10% slump in the technology-heavy Nasdaq 100 Index. However, at least for now, stocks have held up better than we thought given interest rate surge in February.

The S&P 500 Index was down only 2.5% in February. The market’s growthier parts, such as the unprofitable basket was down 6.1%. Defensive and cyclical shares fared better, down less than the overall market.

In our view, the disconnect between bonds and stocks repricing in the face of hotter data is unsustainable, and a near-term weakness is likely in March, especially if the data continues to surprise on the hawkish side.

Market Drivers

The Global Economy

Stronger Than Expected Investors came into the year defensively positioned in anticipation of an imminent recession. However, bearish drivers were less of a threat for most of last year. China seems intent on reopening its economy, and Europe avoided an imminent recession as the warmer winter helped it avoid the widely anticipated catastrophic energy shortages. Additionally, the U.S. consumer, powered by excess savings, higher wage growth, and a resilient labor market, kept the U.S. economy on solid footing. All of this contributed to the high-beta rally. However, a more robust economy means core inflation may stay relatively high in the 3% to 4% range. The immaculate disinflation narrative that took the market in January may be misleading as the Fed would need to do more.

Earnings Are Weak, But Not Falling Off A Cliff

On December 31, 2022, the estimate for S&P 500 earnings growth for the fourth quarter was a decline of 3.3% compared to Q4 2021. With 94% of companies in the S&P 500 reporting as of February 24th, the actual decline in growth is worse than expected. Earnings are on pace to decline 4.8% from a year ago. If we exclude the energy sector, which had an earnings growth of 58%, the S&P 500 earnings growth will be -8.8% for Q4 2022 instead of -4.8%. Revenue growth was actually up 5.4% in the quarter. However, inflation squeezes profit margins leading to lower earnings than a year ago.

Analysts are projecting earnings decline for the first half of 2023 and earnings rebound in the second half. As of February 20, 2023, they project earnings growth of -5.7% and -3.7% for Q1 and Q2 2023 and 3.0% and 9.7% for Q3 and Q4 2023, respectively. In our view, the lagged effects of the 4.75% rise in the Fed funds rate and liquidity withdrawal through Quantitative Tightening (QT) will be more pronounced and evident in the year’s second half. Those positive earnings growth estimates in the second half may prove unjustifiably optimistic given weaker topline growth and declining profit margins into year-end.

Topic of the Month: Business Cycles and Sector Rotation

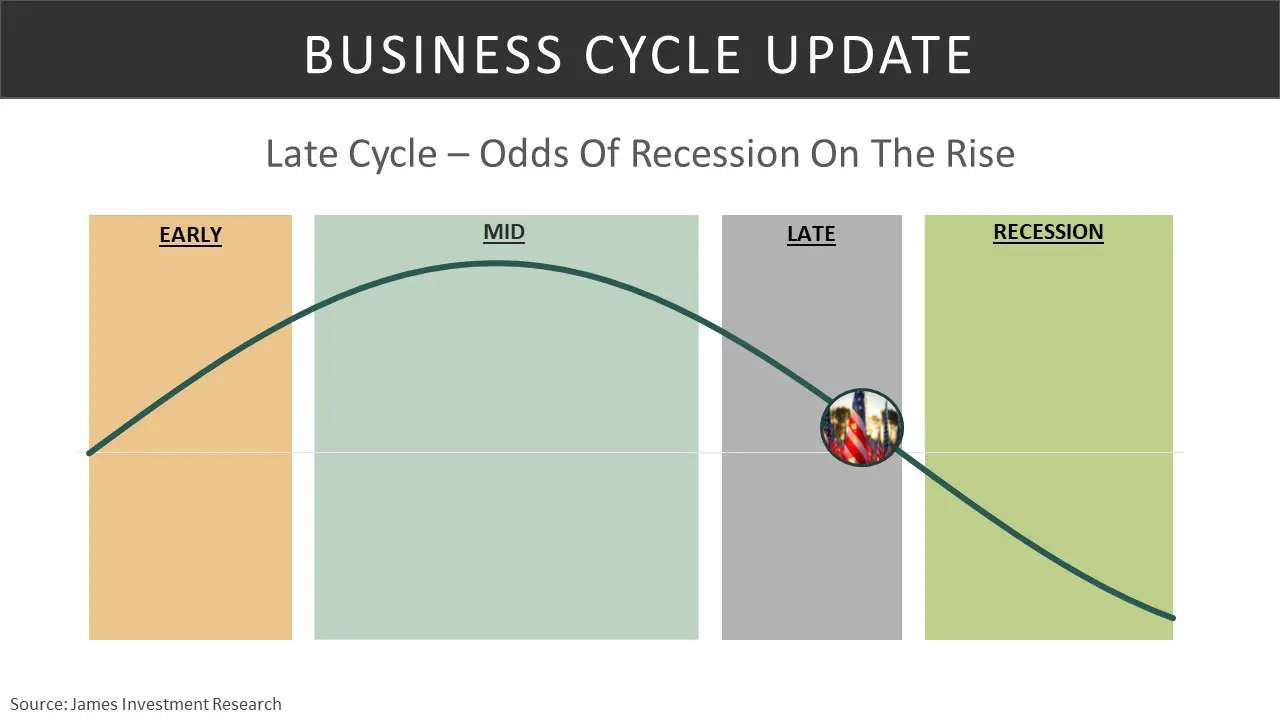

Markets move through various stages over time as changes occur in the economy and financial markets. The different stages of the business cycle strongly impact investment performance. Understanding the history of these stages can help investors identify possible investment opportunities and manage portfolio risk.

Investors should consider allocation and positioning to different asset classes during a business cycle to manage the investment risk among stocks, bonds, cash, and commodities. Further, investors can dig deeper into sectors to identify more specific risks and opportunities. Sectors can be categorized as cyclical or defensive based on their performance in various business cycle phases. Cyclicals such as industrial, consumer discretionary, basic materials, financials, and energy tend to be very sensitive to the level of economic activity. Defensive sectors such as utilities, healthcare, and consumer staples typically weather the storm in periods of uncertainty.

The business cycle starts with the recovery phase after the recession. During this stage, certain assets have performed better than others as riskier assets tend to rebound. Investors look to stocks and commodities as economic activity regains traction and a new bull market emerges. Investors may also favor small capitalization companies over large ones and shift to lower-quality companies as they tend to benefit most from the recovery.

Furthermore, when the economy is healing, growth accelerates, and consumer spending and corporate profits grow. Cyclical sectors have historically performed well during this time, while defensive sectors lagged. Investors favor industrial, consumer discretionary, basic materials, financials, and energy sectors. Additionally, cyclical sectors with commodity-based industries typically perform well as commodity prices advance with rising economic activity.

As the economy improves, it transitions into the mid-cycle phase, where growth and corporate profits peak. Sales remain strong as inventories grow, but the two begin to move together. During this period, a broad range of sectors perform well as economic growth matures. Cyclicals should still do well as growth remains positive during this period.

Eventually, the economy moves further along and into the late cycle. Here growth begins to moderate, and inventories rise as sales growth slows. During this phase, a shift in sector leadership begins to occur. With the economy peaking, investors start to look for mature companies with stable earnings and high dividends. The cyclical sectors, which performed well during the recovery and expansion, give way to more defensive sectors. During this phase, investors shift to consumer staples, healthcare, and utilities as they seek safety.

Ultimately, the economy begins to contract and heads into a recession where growth turns negative, corporate profits decline, and sales fall. Investors during this period shift away from stocks and look to fixed income and cash to help preserve capital. The exposure in equities still favors defensive sectors as safety remains the top priority. Eventually, the depressed prices from the decline during the recession should provide good buying opportunities for companies that may benefit when the market transitions out of the recession.

The phases are never crystal clear, and many outside variables can play a part in determining where you lie within the business cycle. However, careful analysis can help investors put the odds in their favor and manage risk and returns by rotating asset classes and sectors.

James View On The Business Cycle

At the end of 2022, our research suggested the risk of a recession was on the rise in the second half of 2023. Many indicators still suggest we are in a period where things could turn south quickly. The yield curve inversion – rates on short-term bonds are higher than longer-term bonds – has been signally trouble ahead for a while and has historically been a strong indicator of a coming recession. The housing market remains weak as high mortgage rates and elevated home prices stall the industry. We also see manufacturing indicators signaling a severe contraction when measured by purchasing managers’ surveys. Workers added during the pandemic in the technology sector are being laid off as growth slows.

Overall, we currently see the U.S. positioned within the late stage of the business cycle while noting that the risk for a recession is still elevated.

Conclusion

In our January study, we highlighted the disconnect between the Fed’s projection of interest rates and the market expectations. The market rallied on the belief that the Fed would pause soon based on the prior three-month positive inflation data. However, the January economic data showed a more resilient job market, robust retail sales, and higher than expected inflation numbers. As a result, the bond market quickly repriced the new inflation data and the stock market was slow to react. Contingent upon incoming economic data, we believe the downward equity repricing will likely continue, especially if earnings continue to deteriorate.

The late phase in the business cycle may require a more defensive posture. This would suggest we continue to use the playbook from last year and favor defensive sectors over cyclical ones. Investors should avoid excessive stock positioning and favor defensive sectors such as healthcare, consumer staples, and utilities.

Given the resiliency of the labor market, there is still hope that the economy will stave off a recession. It might not be the exact time to buy, but it is a good time to begin identifying strong companies and opportunities in sectors that have been knocked down over the past twelve months. If a recession arises, it may be shallow, allowing investors to add to these companies as the economy rebounds. Despite last year’s dismal results, we still believe bonds should continue to play an essential part in balanced portfolios and we recommend staying with Treasuries and high-quality corporate bonds and low durations.

Sincerely,

The James Research Team

This material is distributed by James Investment Research, Inc. and is for information purposes only. No part of this document may be reproduced in any manner without the written permission of James Investment. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are the opinions of James Investment and are subject to change without notice. James Investment assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved. Copyright © 2023 James Investment.