Webster’s Dictionary defines volatility as “a tendency to change quickly and unpredictably”. During the first quarter of 2023 there is no better word to describe what has happened. January saw a bounce in stocks unlike anything we had seen for quite some time. The S&P 500 Index increased 6.28%, the Russell 2000 Index jumped 9.75% and the NASDAQ Index rallied an incredible 10.73%, all in just one month. Stocks that rallied the most were those that fell the hardest in 2022. We witnessed a snapback in technology and communications stocks, and especially those ‘Meme’ securities, or stocks of a company that have gained in popularity or ‘gone viral’ due to their presence on the internet or through social media. February on the other hand, witnessed the market rally stall and top out just two days into the month. The markets tried to make a comeback in March only to be stopped by issues in the banking sector. Fears of a banking crisis pushed the industry into its own bear market in the period of just three days. Despite a turbulent start to the year, the S&P 500 managed to achieve a modest gain of approximately 7.5% during the first quarter. Much of what occurred with stocks can be said for the fixed income markets as well. Perhaps this is due to the fact stocks rallied as interest rates declined. March on the other hand was a bit different. For the first time in months, we saw the true diversification that bonds can offer in a difficult environment. As worries of a potential bank run swooned, so did bond prices as investors witnessed a true flight to quality. This short rally pushed the Aggregate Bond Index up over 3.2% for the first quarter. The big news continuing to impact the markets is the potential for a banking crisis. Three banks in the United States have failed and moved under receivership year-to-date. On a more global scale, Credit Suisse has faced its own issues in Europe due to its perceived lack of liquidity. If these problems can be contained, the potential for a smooth recovery remains intact. However, if they turn into more of a contagion, the possibility of a recession may become more ominous.

R. Brian Culpepper,

CMFC, CKA President, CEO

James Investment Research, Inc.

President James Advantage Funds

Fall Ainina, Ph.D., CFA

Director of Research

James Investment Research, Inc.

Fund Highlight: James Balanced: Golden Rainbow Fund

The James Balanced: Golden Rainbow Fund currently carries an equity level of 49.5%, just a touch under an even split between stocks and bonds. Within those stock holdings, consumer staples and health care are a bit above their benchmark weightings, representing a way to continue to remain invested in this current rally, however in a slightly more conservative fashion. The Fund is underinvested in financials and thankfully so as banks and their earnings have not recently faired as well as some had hoped.

The remainder of the portfolio is invested in bonds, cash and cash equivalents. The Fund has recently been slowly adding to some longer term bond positions. Higher yields have made a more attractive entry point for these higher duration securities. Not only do these bonds have higher coupons, but those longer dates may help to preserve capital in the event the U.S. economy begins to slow.

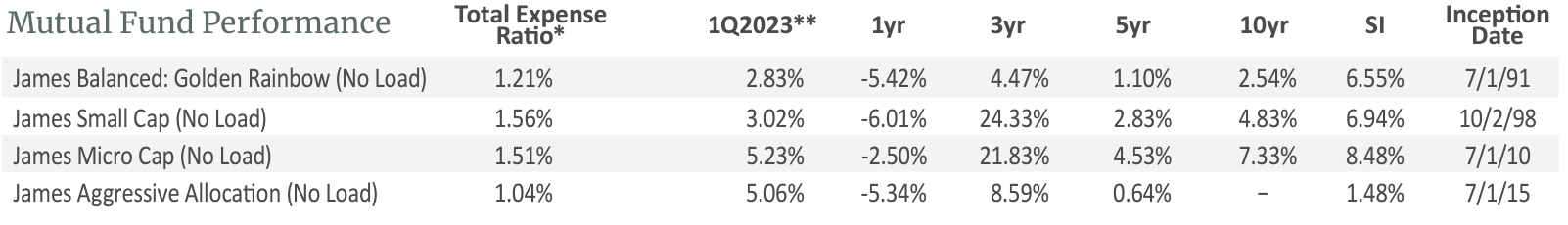

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Funds’ current performances may be lower or higher than the performance data quoted. Investors may obtain performance information current to the last month-end, within 7 business days, at www.jamesinvestment.com. *Total Expense Ratio are expenses deducted from Fund assets. This ratio is as of the 11/01/2022 prospectus. **1st quarter numbers are not annualized. (All other numbers are average annual returns.) The James Advantage Funds are distributed by Ultimus Fund Distributors, LLC, Member FINRA. Call 1-800-995-2637 for a free copy of the prospectus or visit www.jamesinvestment.com. Investors should consider the investment objectives, risks and charges and expenses of the investment carefully before investing. The prospectus contains this and other information about the funds and should be read carefully before investing. Risks: Investing involves risk, including loss of principal. The value of the fund’s shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income prices will fall. Small-Cap investing involves greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat. Micro-cap stocks may offer greater opportunity for capital appreciation than the stocks of larger and more established companies; however, they also involve substantially greater risks of loss and price fluctuations. Micro-cap companies carry additional risks because their earnings and revenues tend to be less predictable. ETF’s are subject to specific risks, depending on the nature of the underlying strategy of the fund. These risks could include liquidity risk, sector risk, as well as risks associated with fixed income securities, real estate investments, and commodities, to name a few. 16796518-UFD-04262023

A James Wealth Management representative can help determine your ability to withstand market volatility, review your accounts, and provide you with potential options to help improve your situation.

Services Include:

- Estate & Legacy Planning

- Transitioning into Retirement

- Insurance Needs Planning

- Investment Planning & Portfolio Management

- Tax Planning

- Major Life Events